NBFCs: A Key Component of India’s Financial Landscape (GS Paper 3, Economy)

Introduction

- The Reserve Bank of India (RBI) has been urging Non-Banking Financial Companies (NBFCs) to adopt prudent growth strategies, emphasizing their long-term sustainability within the financial system.

What are NBFCs?

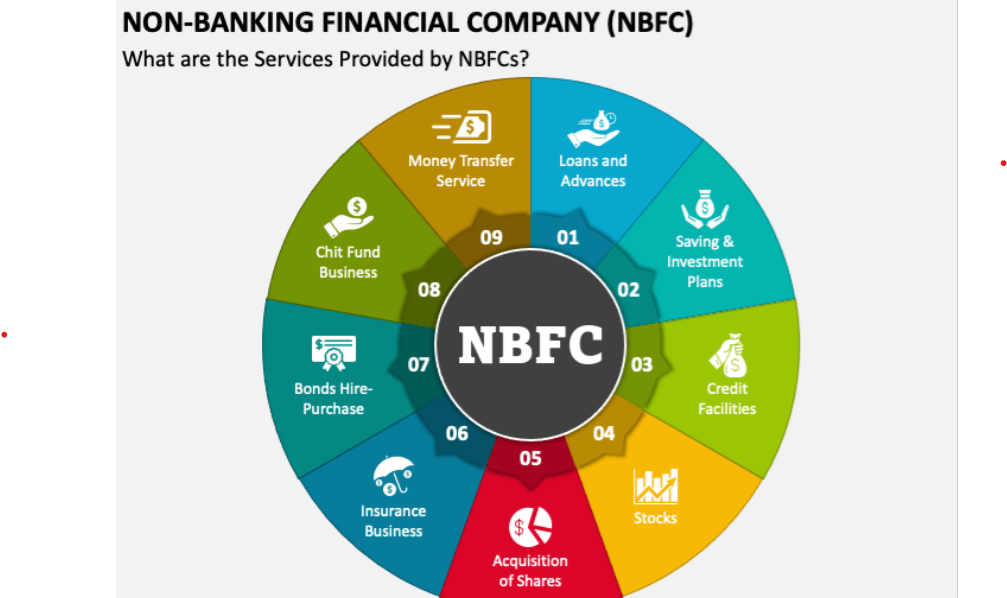

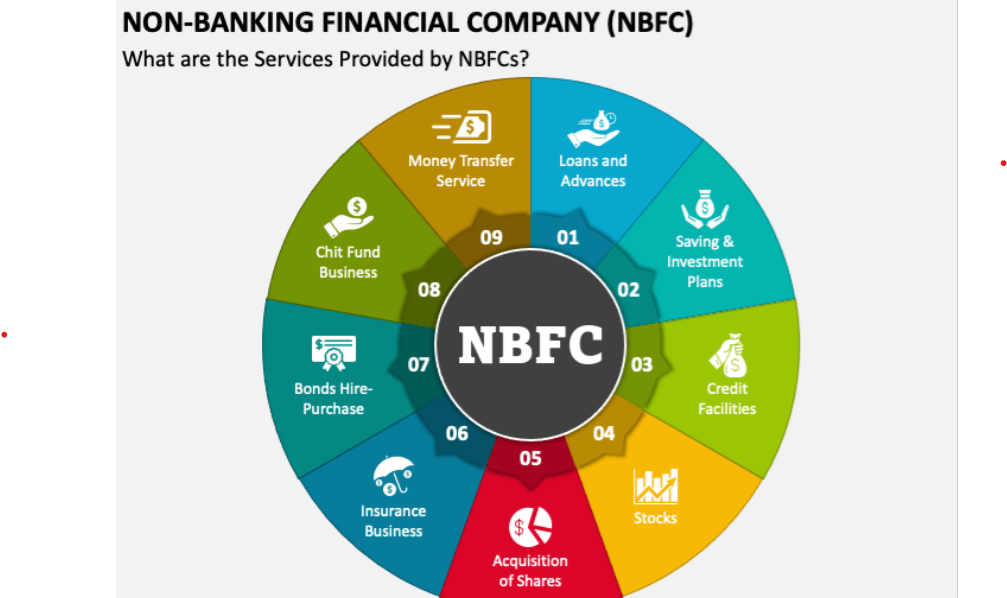

Non-Banking Financial Companies (NBFCs) are entities that are registered under the Companies Act, 1956, and primarily focus on providing financial services. These include:

- Lending: Offering loans and advances to individuals and businesses.

- Investment: Acquiring financial instruments such as stocks, bonds, and debentures.

- Deposit Schemes: Operating various types of deposit schemes.

However, it is important to note that NBFCs do not include institutions engaged in agriculture, industrial activities, or the purchase and sale of goods or property (other than securities). The functioning of NBFCs is overseen by the Ministry of Corporate Affairs and the Reserve Bank of India.

Distinction Between Banks and NBFCs

Though NBFCs provide services similar to those of banks, there are key differences:

- Demand Deposits: NBFCs are not permitted to accept demand deposits.

- Payment Systems: Unlike banks, NBFCs do not participate in the payment and settlement system, nor can they issue cheques drawn on themselves.

- Deposit Insurance: Unlike banks, NBFCs’ depositors are not covered by deposit insurance from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Role of NBFCs in the Financial Ecosystem

NBFCs play a vital role in India’s financial ecosystem, especially in rural and semi-urban areas where the reach of banks is limited. Their contribution includes:

- Financial Inclusion: Extending credit to underserved regions and communities.

- Improved Services: Offering quicker loan disbursements and doorstep services, making financial access more convenient.

- Priority Sector Lending (PSL): Supporting key sectors such as agriculture, microfinance, and small enterprises that are often neglected by traditional banks.

- Economic Growth: By providing financing to critical sectors like housing, infrastructure, and SMEs, NBFCs play a part in India’s overall economic development.

Challenges Faced by NBFCs

Despite their important role, NBFCs face several challenges, which affect their operations:

- Higher Risk Weights: In 2023, the RBI increased the risk weight for loans to NBFCs, making it more expensive for them to borrow from banks. As a result, bank lending to NBFCs dropped significantly from 22% to 15% by April 2024.

- Funding Difficulties: Smaller NBFCs, especially those with lower credit ratings, struggle with a lack of funding options and face increased borrowing costs.

- Limited Debt Market: India’s debt market remains underdeveloped, limiting access to diversified and long-term funding for NBFCs.

- Regulatory Barriers: Regulatory limitations, such as SEBI’s cap on the issuance of International Securities Identification Numbers (ISINs), as well as the absence of market makers, stifle the growth of the bond market.

- Cost Pressures: Rising credit costs, which are expected to increase from 2.6% in 2024 to 4% by 2025, may hurt the profitability of NBFCs.

- International Borrowing Hurdles: While foreign funding offers cost advantages due to reduced hedging costs, many NBFCs are still in the early stages of tapping into international markets.

Way Forward

To ensure the continued growth and sustainability of NBFCs, several steps need to be taken:

- Developing a Robust Bond Market: Building a deep and liquid bond market can provide NBFCs with an alternative to bank funding, helping them raise long-term capital more efficiently.

- Co-Lending Models: Encouraging partnerships between banks and NBFCs can reduce borrowing costs and improve credit distribution.

- Focus on Compliance: NBFCs must prioritize adherence to RBI guidelines on risk management, transparency, and customer service to strengthen their credibility.

- Diversifying Funding Sources: NBFCs should explore various funding options, including securitization, commercial papers, and equity markets, while balancing domestic and international sources of finance.

Conclusion

- NBFCs are an essential pillar of India’s financial system, particularly in promoting financial inclusion and driving economic growth.

- However, challenges such as funding constraints, regulatory pressures, and inefficiencies in the debt market need to be addressed to ensure their continued sustainability and contribution to the broader economy.